Grow Your Wealth 100x

with an expert personalized financial advisor

Comprehensive investment approach

Goal planning & risk analysis

Evaluate short term and long term financial goals, identify risk appetite, financial fitness, and emergency readiness for long-term financial security.

Current financial wealth review

Thoroughly assess current financial standing to identify areas for growth and improvement.

Formulate investment plans

Develop customized investment strategies to optimize wealth and align with financial objectives.

Execute investment plans

Efficiently implement investment strategies, ensuring all actions align with financial goals.

Monitor & review investments

Continuously monitor and regularly review investments to adapt to market changes and goals.

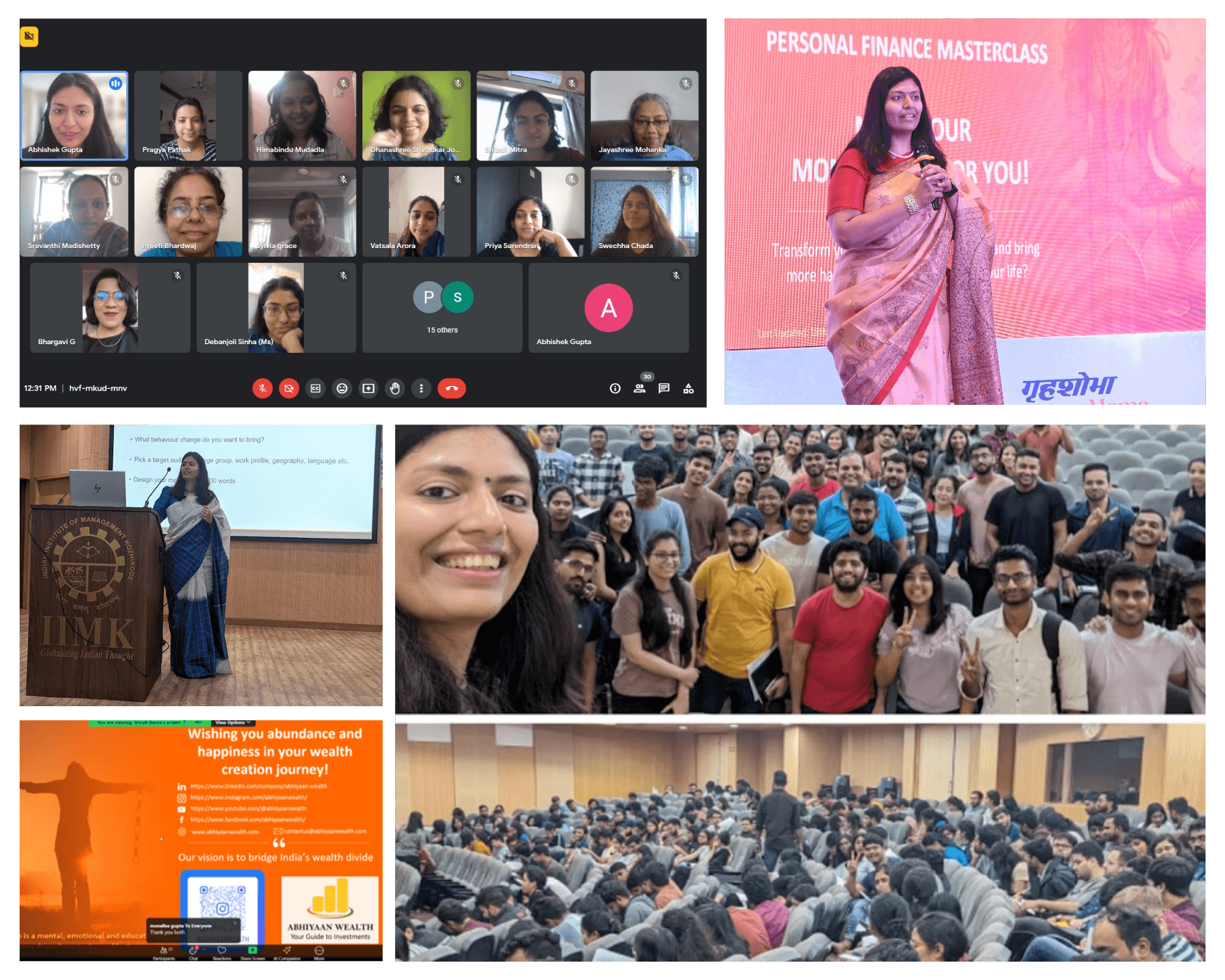

Financial literacy sessions

We currently have 200+ active investors from various backgrounds, including full-time professionals, government and PSU officers, gig or platform workers and homemakers

“I recently worked with Shruti Deora and Abhishek Gupta from Abhiyaan Wealth and couldn't be happier with the results. They thoroughly reviewed my portfolio, offered valuable insights, and provided personalized advice that helped me gain clarity on my financial goals. Shruti Deora guided us to invest in mutual funds rather than prepaying home loans, enabling us to calculate the opportunity cost effectively. Their professionalism and commitment have significantly improved our approach to personal finance. I highly recommend them for expert financial guidance.”

“I had booked Abhiyaan’s free portfolio evaluation call and the benefits I saw from that 1 hr was immense. Shruti was able to point out what I was doing right, what can be better and how better to plan for future goals. I even suggested some family members to take up this call because of the value I saw in it. She and her partner were able to point me to the right direction and levers to enhance my savings growth too. I have started taking small steps and even started investing with them but truly that call was an eye opener in many ways.”

“My husband and I have been associated with Abhiyaan for a year now and I can't tell you the amount of discipline and focus it has brought to our lives. We both are now looking at our finances much differently. I am proud that I now own a house. Through Abhishek's constant support, nudge, and bringing us back on track, we managed the expenses associated with that, decently well. We are now off to our next goal and I'm glad we have Abhishek to support.”

“Abhiyaan Wealth ke sath merko financial knowledge aur disciplined Investment ke baare me pata chala ki kaise apni salary me se kuchh amount invest karna hi chahiye. Pehle mujhe SIP kya hota hai ye bhi nahi pata tha. Abhiyaan wealth ke sath judne ke baad hi mujhe pata chala ki sirf 500 se bhi wealth journey start kari jaa sakti hai.”

“Abhishek, is humble and straight forward which makes it easy to talk about our ideas and challenges.I have become more disciplined in terms of financial investments. It is more so because there is a trust and so far what advices I have received are logically correct, not too risky and over ambitious. It fits right with my risk appetite.”

“I have an overdraft home loan account, l used to park my excess funds there and invest as and when some opportunity came up. I started investing with Shruti’s Abhiyaan and there is disciplined investment in MFs now. I need to give a special shout out for Abhishek! He explains the markets so patiently! I love the accessibility of the team and that adequate time is spent on portfolio review addressing all my queries. Apart from the regular SIPs, I like that I am alerted about any market dips so that lumpsum investments can be made at the right time."

“Besides the development of capabilities such as fundamentals of investing, better understanding of my risk taking abilities and the growth of my portfolio, which by the way is a lot! AW, has been a true advisor, and the kind of advisor we all want to be free from the worries which we associate with money - both too much and lack of it. The fact that I was challenged and channelized every time I had doubts or I was shying away from taking action. It is a great bond we have established, where portfolio is not the end itself but a means to get to a larger goal!"

“Abhishek and Shruti have been immensely helpful in getting clarity into our finances with a thorough study of the state of affairs. We have been seeking their advice before committing to large investments and commitments and making us feel at ease with money matters. I follow a hands-off approach after understanding the investment approach and have seen the difference in the growth. I recommend starting early and that time is now."

Knowledge nuggets from our blog